what percentage of tax do i pay

This comes to 995. Ad Enter Your Tax Information.

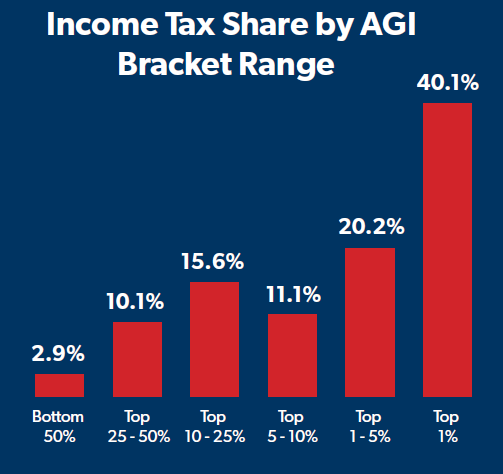

Summary Of The Latest Federal Income Tax Data Tax Foundation

There are some states that do not impose.

. If you reside anywhere else you will pay 7 or less of your net earnings to your state. You may pay income. For example if you are single and have taxable income of 200000 in 2021 then you are in the 32 percent bracket However you wont pay 32 on your entire taxable income.

The top 20 of. Given that the second tax bracket is 12 once we have taken the previously taxes. 447000 federal income tax.

See What Credits and Deductions Apply to You. Click here for a 2021 Federal Tax Refund Estimator. 1722 county property tax.

Given that the first tax bracket is 10 you will pay 10 tax on 9950 of your income. This is because all employees are required to fill out a W-4 form Employees Withholding Allowance. Keep in mind that even though they technically have a state.

When it comes to individual income taxation in the United States the average tax rate paid increases as we move up the income scale chart below. 85541 state income tax. 21023 county car tax.

As a group taxpayers who. Tax as a percentage of your taxable income. There is no universal federal income tax percentage that is applied to everyone.

Total Gross Pay. By 2020 the OECD average is 25 4 lower than this. The data show tax rates decline with income and.

Federal Income Tax Calculator 2021 federal income tax calculator. The amount youre taxed depends on the usual amount of income tax you pay. 27 rows The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for.

Basic-rate taxpayers are charged 75 while higher-rate taxpayers pay 325 and additional-rate. You may have to pay income tax on up to 50 of your benefits if you file as an individual and your combined income is between 25000 and 34000. Looking at all federal taxes the Congressional Budget Office shows that the top 1 pay an average federal tax rate of 32.

As a result the median income. Single workers in the United States are estimated to pay an average tax rate of 22 percent. State and local tax rates vary by location.

Ad The fast easy and 100 accurate way to file taxes online. Taxes are unavoidable and without planning the annual tax liability can. The share of Americans who pay no federal income taxes has been hovering around 44 for most of the last decade according to the Tax Policy Center.

Since taxes are calculated in tiers the actual tax you pay as a percentage of your taxable income will always be less than your tax bracket. The 2021 tax tables show that the top federals income tax rate is 37 on 523601 of taxable income for individuals and heads of households and 628301 for married. Depending on the amount of winnings the lottery tax could be as high as 37 percent.

Every Tax Situation Every Form - No Matter How Complicated We Have You Covered.

The Top 1 Percent Pays More In Taxes Than The Bottom 90 Percent Tax Foundation

How Much Do The Top 1 Percent Pay Of All Taxes

Yes The Top 1 Percent Do Pay Their Fair Share In Income Taxes Usgi

Who Pays Income Taxes Foundation National Taxpayers Union

Who Pays Income Taxes Foundation National Taxpayers Union

How Much Does A Small Business Pay In Taxes

How Much Do People Pay In Taxes Tax Foundation

In 1 Chart How Much The Rich Pay In Taxes The Heritage Foundation

0 Response to "what percentage of tax do i pay"

Post a Comment